You won't believe what is happening in the Northern New Jersey Housing Market! Check out SEGInsider.

On a Mission To Help Clients Win in Real Estate

Real estate isn't about a singular transaction. It's about building your family's generational wealth with a long term real estate strategy. Our strategy has been featured in Good Morning America, NBC's Today Show, EW's American Dream, CBS and more!

Let's meet to discuss your goals, build a plan and guide you along the way to make sure you win!

TOP 1%

OF REAL ESTATE TEAMS IN BERGEN COUNTY

> 1 BILLION

IN LIFETIME SALES

Real Experts. Real Results.

We Stage, Style and Sell Your Home Using Our Proven Value-Up Seller Method.

MEET THE TOP NJ REALTY TEAM

Behind These Results

If you want top results, work with the top agents in Northern New Jersey

Don't settle for just any realtor—partner with a top-ranked professional to navigate the real estate market with confidence and achieve your goals. Top realtors get you:

Market Insight: Top-ranked realtors possess deep knowledge of local markets, trends, and pricing dynamics. Their insights can help you make informed decisions, whether you're buying or selling, maximizing your investment potential.

Negotiation Skills: Real estate transactions often involve complex negotiations. With a top-ranked realtor on your side, you benefit from their exceptional negotiation skills, ensuring you get the best deal possible in any situation.

Access to Networks: Top-ranked realtors have extensive networks within the industry, including other professionals like lenders, inspectors, and contractors. Leveraging these connections can streamline the buying or selling process and address any challenges that may arise swiftly.

WHAT'S YOUR

REAL ESTATE

STRATEGY?

Considering your next moves?

Unsure about your next chapter?

You're 4 Steps Away From Success

We will learn about your goals.

We will build a strategic plan.

We will help you put the plan to action.

Walk away with a tailor made success plan

Whether you are a buyer or a seller, having a strategy to plan your next real estate endeavor is key to success.

We put our clients first and that's why we don't offer listing appointments or buyer consultation. We start with strategy first, understanding your unique situation, rather than selling you the features and benefits of hiring an agent. We want to help you build your long-term real estate strategy and that starts with understanding your needs first and how to maximize value.

Get in touch today. We’re happy to discuss your unique housing situation and answer your questions—from the simplest inquiry to the most complex. Reach out and put your market worries to rest.

Ready to get your Success Plan to win in Real Estate?

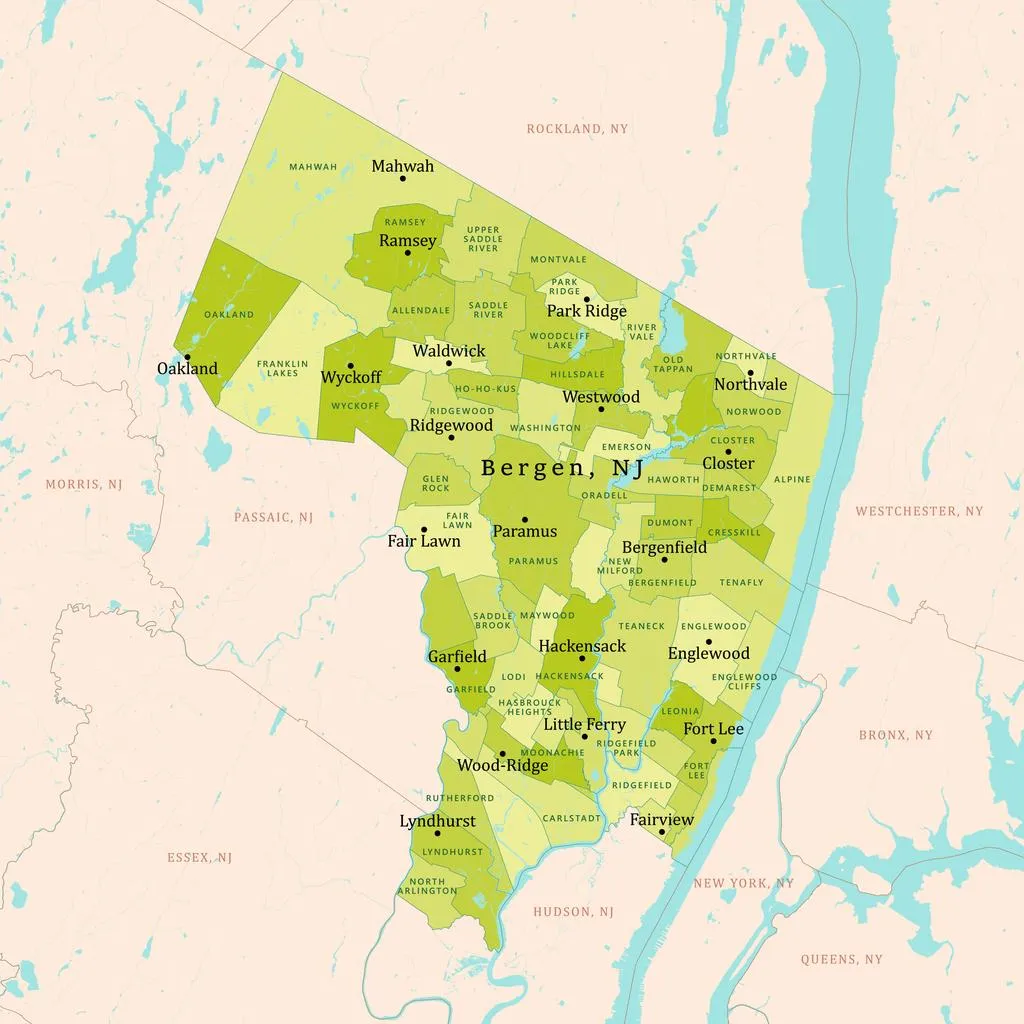

Homeowners are Winning Big in Bergen County

SELLERS GUIDE

WITH PROVEN RESULTS TO SELL ABOVE MARKET PRICE!

How to Definitively

Make More Money On Your Home

Sell at the right time. Not every market is right for your location. Appreciation in Bergen County varies based on your city and it's important to know when the right time to make the most money.

There is one question we need to ask. Learn the one question that will transform your home's value!

Prepping your home is key to success. A little bit of prep love goes a long way to increase your value.

Do you have a home in Bergen County?

Our Value Up Method has helped hundreds of homeowners in Bergen County get maximize value for their home and easily segue into the next chapter of their lives with more money in their pockets!

In this Value-Up Strategy Consultation, you will:

Instantly know if you should stay or sell your home - even if you tried before and failed

Get Your shortcut to know what your home will sell for and avoid missing out on an opportunity to sell your home for maximum value.

Learn the amazing home prep tips every homeowner can use to get the highest sales price for your home. PLUS get customized tips for your home.

Eliminate needless stress over what to do next with our customized Roadmap to SEGue into the next chapter of your life.

4 Steps to Seller Success

Step 1. Get the estimated value of your home in it's present state for your starting value.

Step 2. Learn our proven method to get more value from your home.

Step 3. Create a Personalized Strategy To Make More Money

Step 4. Always Ask these 4 Powerful Questions of your Realtor

LET'S BUILD YOUR

REAL ESTATE SUCCESS PLAN.

Whether you're buying or selling, a smart strategy is crucial for success. We prioritize our clients by starting with strategy, not sales pitches. Our goal is to understand your needs and maximize value, ensuring a long-term real estate plan tailored to you. Reach out today to discuss your housing needs and put your market worries to rest.

Get in touch today. We’re happy to discuss your unique housing situation and answer your questions—from the simplest inquiry to the most complex. Reach out and put your market worries to rest.

Real estate isn’t about the singular transaction. It’s about helping your family build generational wealth.

Our Value Up Method has helped hundreds of homeowners in Bergen County get maximum value for their home and segue into their next chapter with more money in their pockets!

Considering Selling your home in Bergen County?

Schedule your Value-Up Session to receive:

A Deep-dive personalized success plan to get top dollar for your home

Low Effort, High Impact Prep Tips to get the highest sales price for your home, customized to your home

A Personalized Pricing Strategy backed by market insights

A custom SEGue Roadmap to eliminate needless stress over what to do next and seamlessly segue into the next chapter of your life

Our Clients Win Big.

Client Care: (201) 500-2212

25 Washington Street, Tenafly NJ 07670

Stacy Esser Consulting LLC

Copyright @ 2024